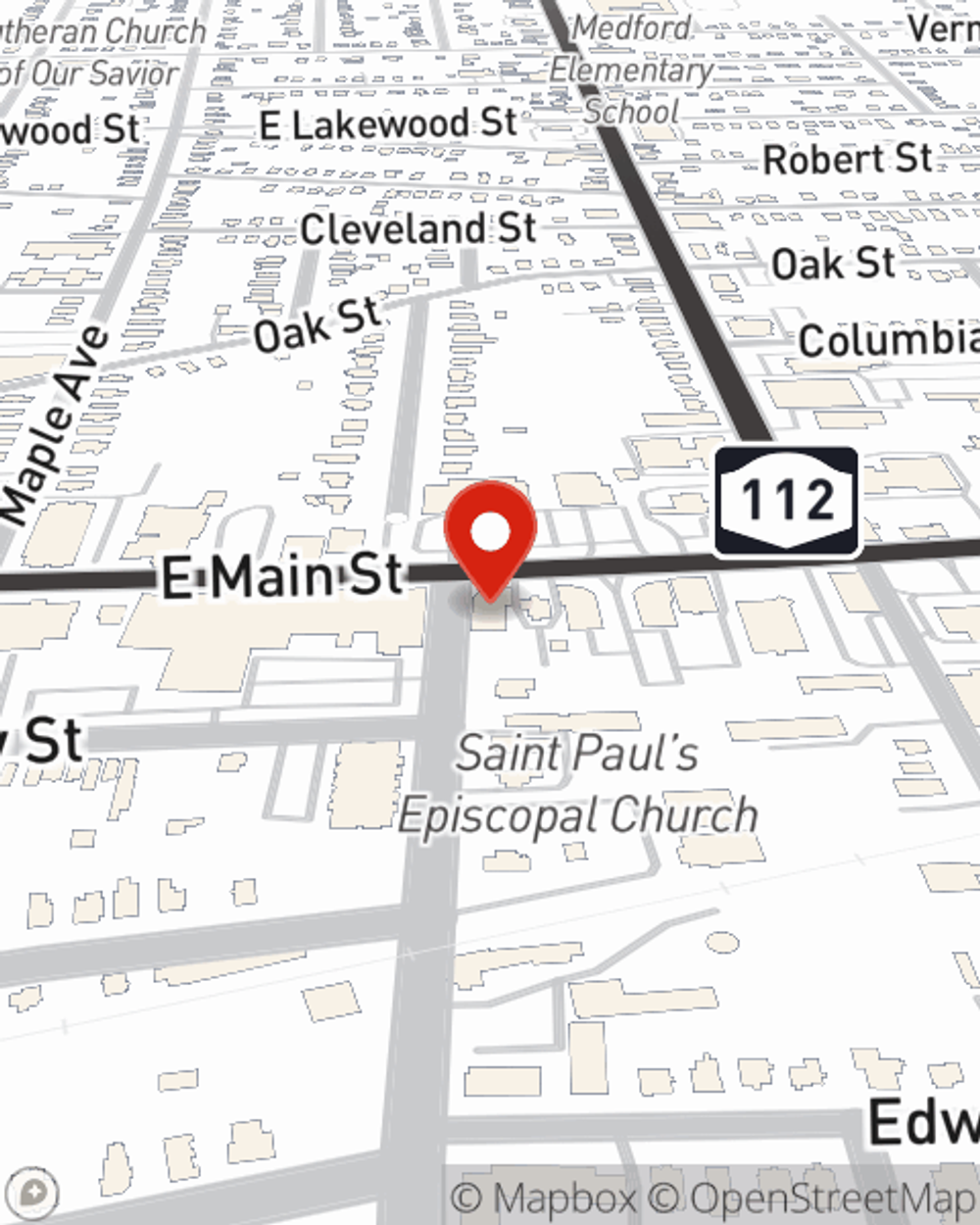

Business Insurance in and around Patchogue

Looking for small business insurance coverage?

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Running a small business is no joke. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, retailers and more!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Cover Your Business Assets

When one is as passionate about their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for business owners policies, artisan and service contractors, commercial auto, and more.

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Ken Kortright's office today to review your options and get started!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Ken Kortright

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.